WHAT THE EV. Part I: The Titans of Transport: Who Really Owns the EV Market?

The Electric Empires

The electric revolution unfolds across continents, through boardrooms and battery factories, in lithium fields and legislative chambers. Power accumulates not merely in kilowatt-hours but in control over mobility's future architecture.

BYD – The Silent Superpower

While Western media trains its cameras on Fremont and Berlin, a different empire rises in Shenzhen. BYD-"Build Your Dreams"-began as a battery maker in 1995, accumulating decades of chemical knowledge before others knew electrons would replace gasoline.

By Q4 2023, deliveries tell a story headlines missed: BYD's 526,000 electric vehicles surpassed Tesla's 484,000. Annual totals reveal the scale, 3 million BYD vehicles (including hybrids) against Tesla's 1.8 million. In Chinese streets, where 35% of EVs bear BYD badges, the $11,000 Seagull democratizes electric mobility while Western automakers chase luxury margins.

From lithium mines to software studios, from nickel refineries to chip fabrication, BYD commands each link in its chain. The Blade Battery, lithium iron phosphate chemistry promising 1.2 million kilometers of life, flows from BYD factories into Tesla, Ford, and Toyota vehicles. "BYD exports not vehicles but China's mobility architecture," an EU trade analyst observed in 2024, watching 1,500 BYD buses navigate Bogotá's streets, factories rise in Thailand and Hungary.

Beijing's hand guides through tax relief, through land grants, through export facilitation. State and corporation merge in ways Western regulatory frameworks struggle to parse.

Tesla The Icon in the Crossfire

Tesla remains synonymous with electric dreams-velocity, innovation, disruption. Yet beneath Gigafactory facades and Autopilot promises, dependencies web like neural networks:

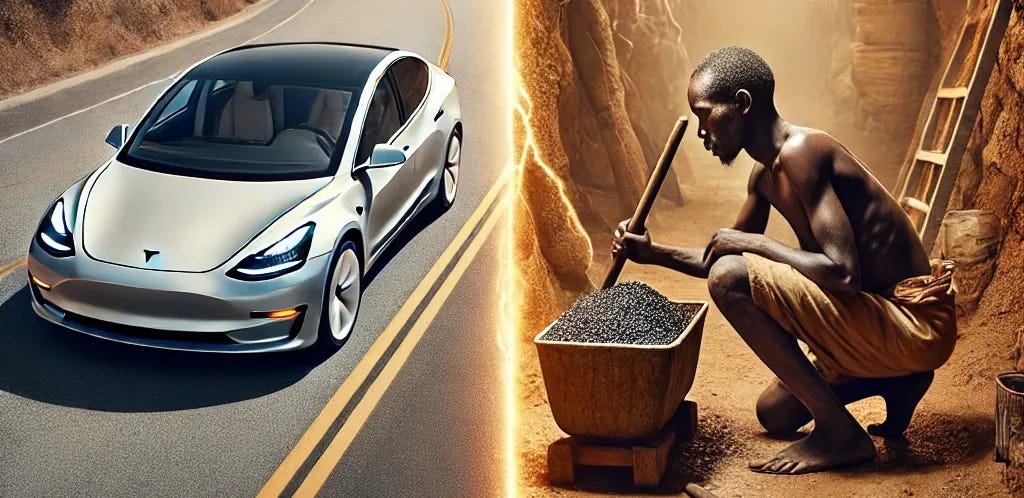

Graphite flows exclusively from Chinese processors. Every Tesla anode depends on this single source. Lithium travels from Australian and South American earth through Chinese refineries. Batteries emerge from CATL and Panasonic facilities, some tainted by Congolese cobal, where 40,000 children, some merely 10 years old, descend into tunnels for 12-hour shifts at $2 daily wages.

China's tightening grip on graphite exports exposes these vulnerabilities. Musk's response traces a familiar pattern: promises cascade toward vertical integration. Lithium refineries planned for Texas. Assurances of "raw material independence." Yet years separate announcement from achievement.

Where metal meets code, Tesla's transformation accelerates. Full Self-Driving algorithms mature in silicon valleys. Over the air updates reshape vehicles overnight. Robotaxi fleets gestate in beta tests. "The car has become the app store," a former systems architect revealed in 2023, "and the app store has become the car."

Volkswagen Group – Europe's Last Fortress

Volkswagen transcends corporate identity, 650,000 employees across 19 countries embody European industrial ambition. Yet pressures mount from every vector:

Energy costs in Germany strangle battery production economics. Raw materials remain foreign dependencies, no European lithium, cobalt, or nickel at scale. Chinese operations, once profit centers, transform into geopolitical liabilities.

Twenty billion euros flow toward battery sovereignty: gigafactories germinate in Germany, Spain, Canada. Northvolt partnerships promise European cells for European cars. Cariad, VW's software division, attempts to encode automotive futures in European languages. "Economic sovereignty wears an electric disguise," leaked 2024 board notes revealed.

VW's environmental mission statement promises to "minimize environmental impacts along the entire lifecycle, from raw material extraction until end-of-life." Yet Congolese children still break rocks in the lifecycle's shadows.

The Battery Lords – The True Kings

Behind every electric throne stand the chemical sovereigns:

CATL commands 37% of global battery production, supplying Tesla, BMW, Ford with cells aligned to Beijing's blueprints. LG Energy Solution partners with GM and Honda while investing in Indonesian nickel, maintaining DRC cobalt connections. Panasonic, Tesla's first ally, leads solid-state development from Japanese laboratories. Northvolt waves Swedish sustainability flags while sourcing from the same shadowed supply chains.

These names rarely headline quarterly earnings calls or auto show reveals. By design. "Every battery contains a political contract written in rare earth elements," an NGO monitor noted in 2023, tracing mineral flows from mine to motherboard.

Beneath the Branded Surface

Mainstream coverage maps charging networks, calculates carbon offsets, profiles executive personalities. The architecture of control remains unexamined:

Lithium concessions concentrated in few hands across fewer nations

Refineries processing under state supervision and corporate secrecy

Cobalt extracted by children working beneath armed oversight

Software systems determining not just route but possibility itself

"The companies know their supply chains' origins," a Congolese activist told CBS Mornings in 2025, standing before mines where children earn $2 for risking their lives. "Knowledge doesn't translate to change when profits depend on blindness."

From oil wars to mineral conflicts, from petroleum geopolitics to electron economics-the game remains extraction and control, merely shifting longitude and chemistry.

Coming Next – The Mineral Wars

These transport titans rest on foundations few examine: the mineral empire stretching from Atacama's lithium pools to Congo's cobalt pits, from Indonesian nickel mountains to Chinese graphite furnaces.

Part II. "Blood Lithium, Broken Supply Chains & the Mineral Empire", descends deep into extraction's reality:

Through DRC mines where childhood ends at tunnel mouths

Across Chilean salt flats draining Indigenous aquifers

Into the bottlenecks of nickel, graphite, and vanadium supply

The green transition runs on red minerals. Subscribe to trace the map from mine to motor, from suffering to sustainability theater.